Mapping your financial data

...

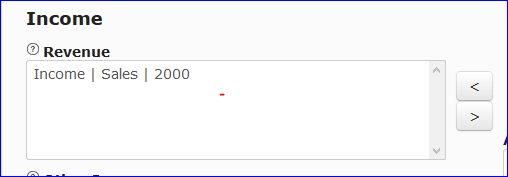

Revenue-Income

Income | Sales | 2000

Income | Sales - Cash, chq | 2001

Income | Merchant and Deposits | 4-1100

ExamplesOther Income

Income | Commission - Cemetery | 4-6500

Income | Interest Income | 2700

Income | FBT Reimbursement | 81440

Income | Goodwill Cashback | 81500

Income | Distributions Rec | 81250

Income | ATO Cash Flow Boost (CFB) | 2655

Income | Distributions from Trust | 2500

Income | Profit from sale of Assets | 2900

Income | DETR - education for employees | 2602

Income | FBT Employee Contribution | 275

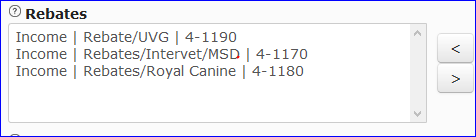

ExamplesRebates

Income | Rebates | 2700

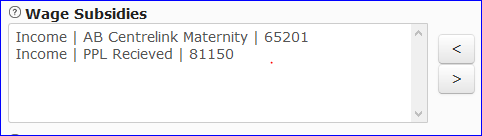

ExamplesWage Subsidies

Income | Govt. Grants - Staff | 4-4111

Income | Paid Parental leave Payments recd | 2600

Income | Maternity Leave - Gov Contribution | 62331

Income | Workcover Reimbursement | 232

Income | Trainee Subsidies from Government | 203

Income | Jury Service Allowance Received | 2602

ExamplesStaff Hire Income

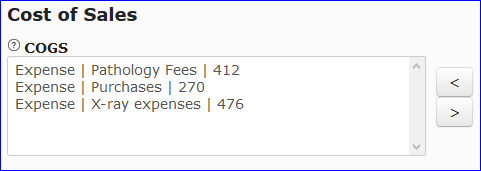

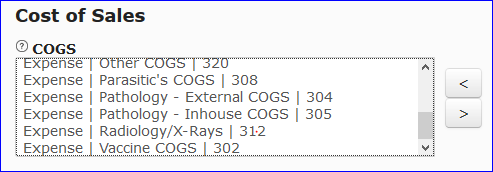

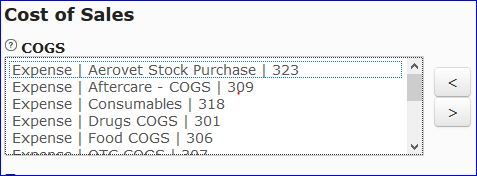

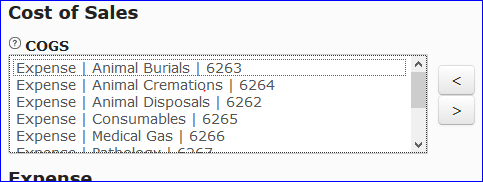

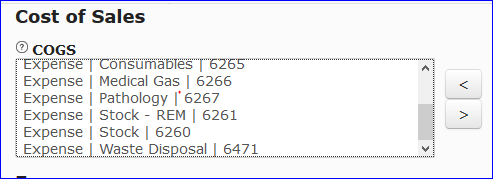

Cost of Sales - COGS

Expense | Cremation and Clinical waste | 3009

Expense | Drugs & Purchases | 3005

Expense | Lab & Pathology | 3008

Expense | Oxygen | 3006

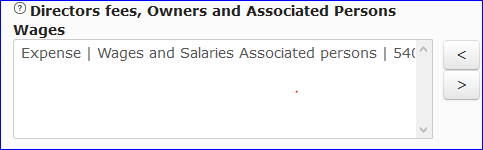

ExamplesDirectors fees, owners and Associated Persons Wages

Expense | Wages and Salaries Associated persons | 5404

Expense | Shareholder Salaries - Vet | 476

Expense | Superannuation Associated persons | 5423

Expense | Dividend Paid or Provided | 5950

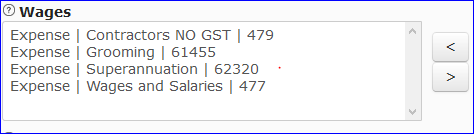

ExamplesWages

Expense | Wages and Salaries Nurses | 5401

Expense | Wages and Salaries Veterinarians | 5402

Expense | Wages and Salaries Support Staff | 5403

Expense | Wages and Salaries | 5404

Expense | Superannuation | 6210

Expense | Groomer | 4300

Expense | Locum Nurse | 5411

Expense | Locum Veterinary Fees | 5410

ExamplesRent

Expense | Rent | 4690

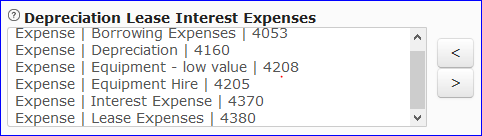

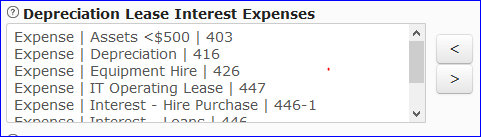

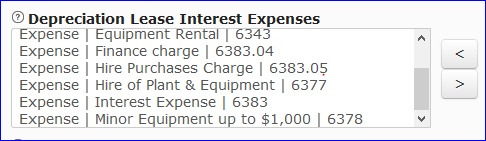

ExamplesDepreciation Lease Interest Expenses

Expense | Depreciation | 4160

Expense | Equipment Hire | 4205

Expense | Borrowing expenses | 4160

Expense | Amortisation Expense | 402

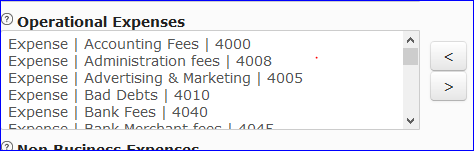

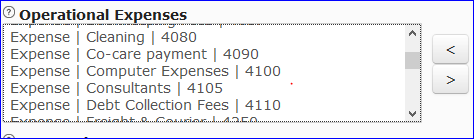

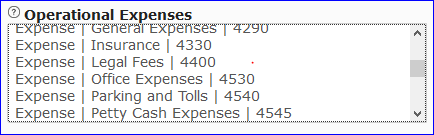

ExamplesOperational Expenses

Expense | Accountancy fee | 6300

Expense | Staff training and Conferences | 6560

Expense | Consultants | 4105

Expense | subscription | 6600

Expense | Professional Liability Insurance | 6300

Expense | Specialist Fees | 6700

Expense | Travel and Accommodation | 6800

Expense | Workers Compensation | 5430

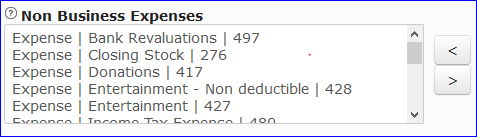

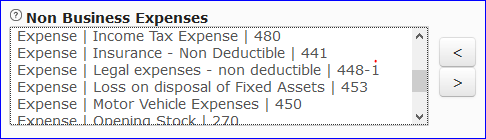

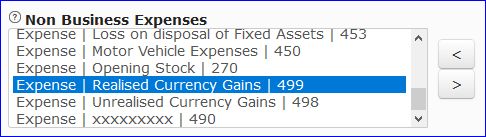

ExamplesNon Business Expenses

Expense | Motor Vehicle Expenses | 450

Expense | Payroll Tax | 5407 ( because comparing practices has to be the same. ) Could be in wages ??

Expense | Donations | 417

Expense | Filing fees | 6270

Expense | Closing Stock | 276

Expense | Opening Stock | 270

Expense | Unrealised Currency Gains | 498

Expense | Prior Period losses applied | 5850

Expense | Bank Revaluations | 497

Expense | Formation expenses | 4244

Expense | Income Tax Expense | 5900

Expense | Goodwill license Fee | 61075 *****

Regions vary

Examples

PST Provincial sales tax (BC)

...